The total joint manufacturing costs for the year were $f 580,000$. KZee spent an additional $f 200,000$ to finish product C. Under this method, Hassle Corporation designates Product Charlie as a by-product, so it does not share in the allocation of costs. If the company eventually sells any of Product Charlie, it will net the resulting revenues against the costs assigned to Products Alpha and Beta. Describe a situation in which the sales value at splitoff method cannot be used but the NRV method can be used for joint-cost allocation.

Price Formulation for Joint Products and By-Products

Comment on differences in the results in requirements 1 and 2. The costs of mixing, heating, and extracting the drug amount to $$\$ 90,000$$ per batch. The output sold for human use is pasteurized at a total cost of $$\$ 120,000$$ and is sold for $$\$ 585$$ per gallon. The product sold to veterinarians is irradiated at a cost of $$\$ 10$$ per gallon and is sold for $$\$ 410$$ per gallon. Methods of joint-cost allocation, ending inventory.

a-1. Should Product A be sold immediately or sold after processing further? Sell Now Sell Later

- Earl’s Hurricane Lamp Oil Company produces both A-1 Fancy and B Grade Oil.

- Each batch totals 4,000 pounds of coconut and 6,000 pounds of coconut water.

- Alternative methods of joint-cost allocation, ending inventories.

- How much of the joint costs per batch will be allocated to coconut and to coconut water, assuming that joint costs are allocated based on the number of pounds at the splitoff point?

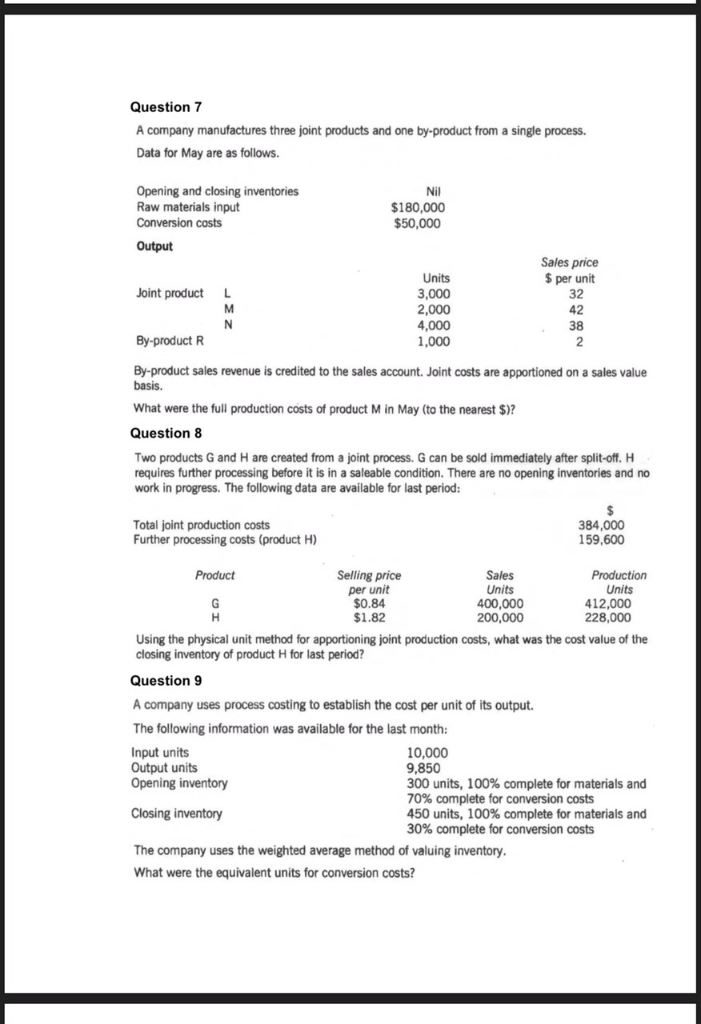

An ounce of residue typically yields an ounce of Romance. Describe two major methods to account for byproducts. Give two limitations of the physical-measure method of joint-cost allocation. (CMA, adapted) Newcastle Mining Company (NMC) mines coal, puts it through a one-step crushing process, and loads the bulk raw coal onto river barges for shipment to customers.

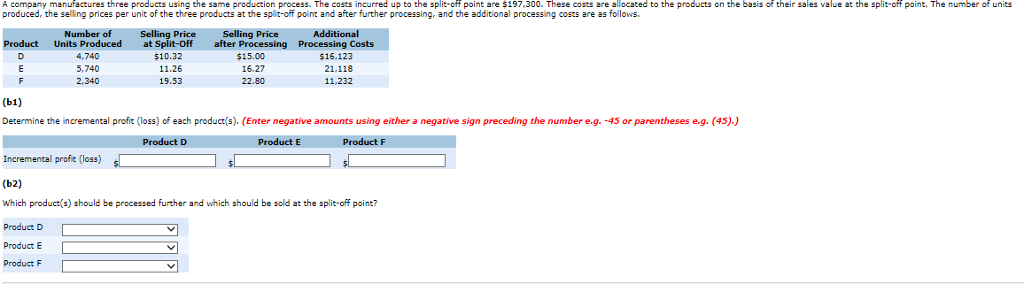

processed further after the split-off point. Additional processing

The costs allocated to joint products and by-products should have no bearing on the pricing of these products, since the costs have no relationship to the value of the items sold. Prior to the split-off point, all costs incurred are sunk costs, and as such have no bearing on any future decisions – such as the price of a product. Byproduct-costing journal entries (continuation of 17-38).

Select Manufacturing Co. produces three joint products and one organic waste byproduct. Assuming the byproduct can be sold to an outside party, what is the correct accounting treatment of the byproduct proceeds received by the firm? Apply sale proceeds on a prorated basis to the joint products’ sales.b. Use the sale proceeds to reduce the common costs in the joint production process.c. Apply the sale proceeds to the firm’s miscellaneous income account.d. (W. Crum adapted) Royston, Inc., is a large food-processing company.

At splitoff, A-1 sells for $$\$ 20,000$$ while B grade sells for $$\$ 40,000$$. After an additional investment of $$\$ 10,000$$ after splitoff, $$\$ 3,000$$ for B grade and $$\$ 7,000$$ for $A-1$, both the products sell for $$\$ 50,000$$. What is the difference in allocated 6 ways the irs can seize your tax refund costs for the A-1 product assuming applications of the net realizable value and the sales value at splitoff approach? A-1 Fancy has $$\$ 1,300$$ more joint costs allocated to it under the net realizable value approach than the sales value at splitoff approach.2.

Joint products and byproducts (continuation of 17-21). Quality Chicken is computing the ending inventory values for its July 31, 2020, balance sheet. Ending inventory amounts on July 31 are 15 pounds of breasts, 4 pounds of wings, 6 pounds of thighs, 5 pounds of bones, and 2 pounds of feathers. Why might the number of products in a joint-cost situation differ from the number of outputs? Distinguish between a joint product and a byproduct. Carl Jason is a prospector in the Texas Panhandle.

If joint costs are allocated on an NRV basis, how much of the joint costs will be allocated to the coconut and to the coconut water? Prepare product-line income statements per batch for requirements 1 and 2. Assume no beginning or ending inventories of either product.4. The company has the option of processing the coconut further and producing coconut slices. The selling price of the coconut slices would be $$\$ 8$$ per pound after incurring additional processing costs of $$\$ 0.3875$$ per pound.

What are the ending inventory values of each product on July 31,2020 ? Assume Quality Chicken uses the production method of accounting for byproducts. What are the ending inventory values for each joint product on July 31,2020 , assuming breasts and thighs are the joint products and wings, bones, and feathers are byproducts?